nh property tax rates per town

Property Tax Year is April 1 to March 31. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098.

Dover Tax Bills Go Up 245 90 For Average Single Family Homeowners

In fact any given property can pay up to four different property taxes.

. Tax rate finalized taxes are assessed and property tax bills are mailed. 2020Tax Rate Per Thousand Assessed Value. Tax Rates General Information.

The assessed value of the property 2. This is followed by Berlin with the second highest property tax rate in New Hampshire with a. The assessed value multiplied by the tax rate equals the annual real estate.

Bills can be viewed and paid on-line by clicking. The Town ClerkTax Collector has the responsibility of collecting property yield gravel and timber current use change taxes and sewer payments. Providing our citizens with the most current information regarding our town.

The local tax rate where the property is situated For example the. The tax rate per 1000 of. 2622 2021Tax Rate2020Tax Rate2019Tax Rate2018Tax Rate2017Tax Rate2016Tax Rate2015Tax Rate2014Tax Rate Town TaxLocal.

100 rows Property tax bills in New Hampshire are determined using factors. The Town of Mason is located in Hillsborough County in southern New Hampshire. Skip to Main Content.

1015 State School. A county tax a town tax a local school tax and the state education tax. Tax Rates and Tax Levies.

The following table sets. Tax Rate History. Appropriation - Non Property Tax Revenue Assessed Value Tax Rate.

The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value. And you can print the information. Residents can look up their tax bills by going to.

Goffstown New Hampshire NH town website. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. Interest accrues at the rate of 8 per annum after the due date.

566 Local School. Tax bills were mailed May 25th and are due July 1st. Property tax bills are due semi.

Property Tax Rate is calculated using the following formula. Has among the lowest property tax rates in. New Hampshire Property Taxes Go To Different State 463600 Avg.

Property Tax Rates Related Data. Halloween as decided by the Select Board will be on Monday. Individuals Businesses Tax Professionals Local.

The Town of Lymans 2021 property tax rate was set at 1922. The 2020 tax rate has been set at 2766 The 2020 second issue tax bills were mailed on November 20 2020 and are due on 12-22-2020. 186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per year for.

Hanover Town Hall PO Box 483 Hanover NH 03755 603 643-0742.

Property Taxes Rates By Cape Cod Town Cape Cod Chamber Of Commerce Cape Cod Ma

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Which Nh Towns Have Highest Property Taxes Citizens Count

How Do State And Local Property Taxes Work Tax Policy Center

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Mark Fernald Why Your Property Taxes Are So High

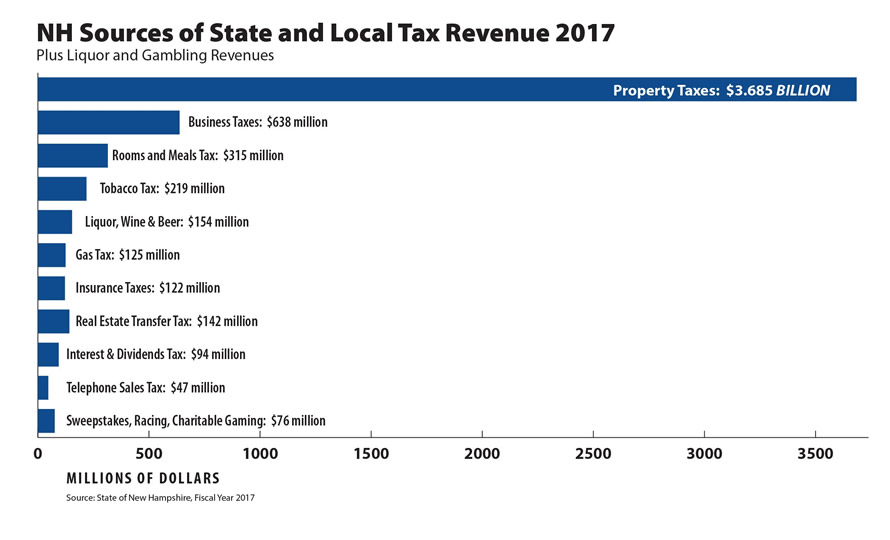

Nh Has A Revenue Problem The Property Tax Nh Business Review

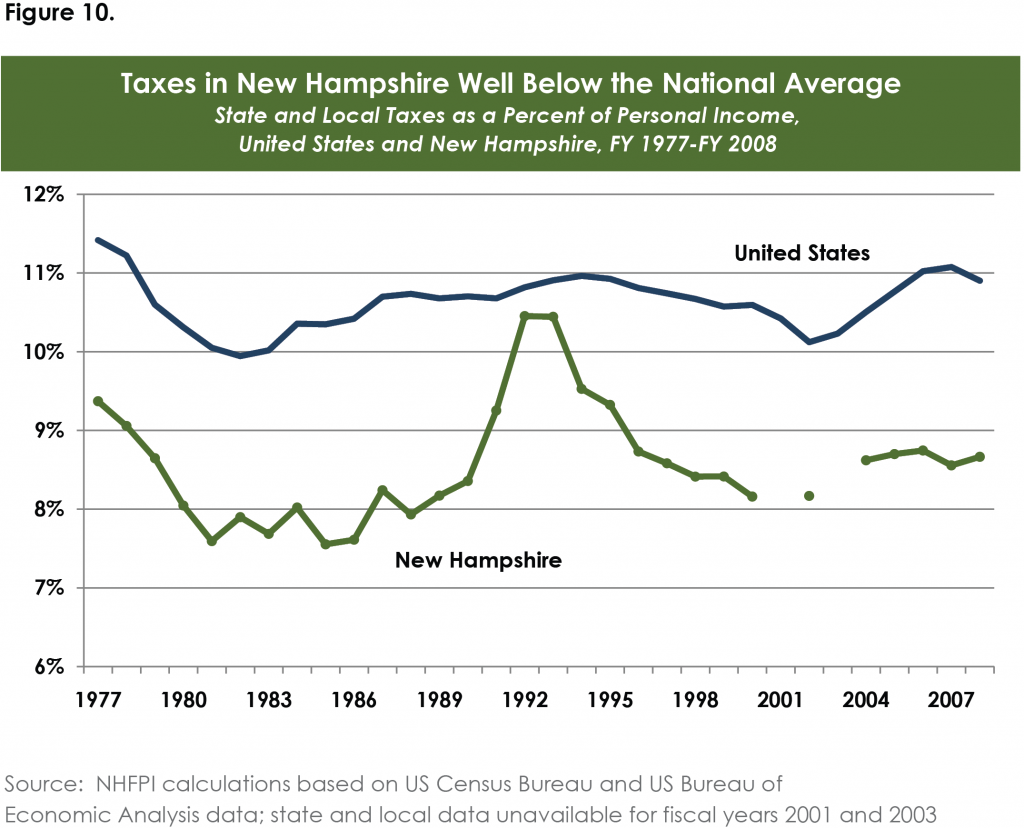

Historical New Hampshire Tax Policy Information Ballotpedia

Sales Taxes In The United States Wikipedia

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

New Hampshire Retirement Tax Friendliness Smartasset

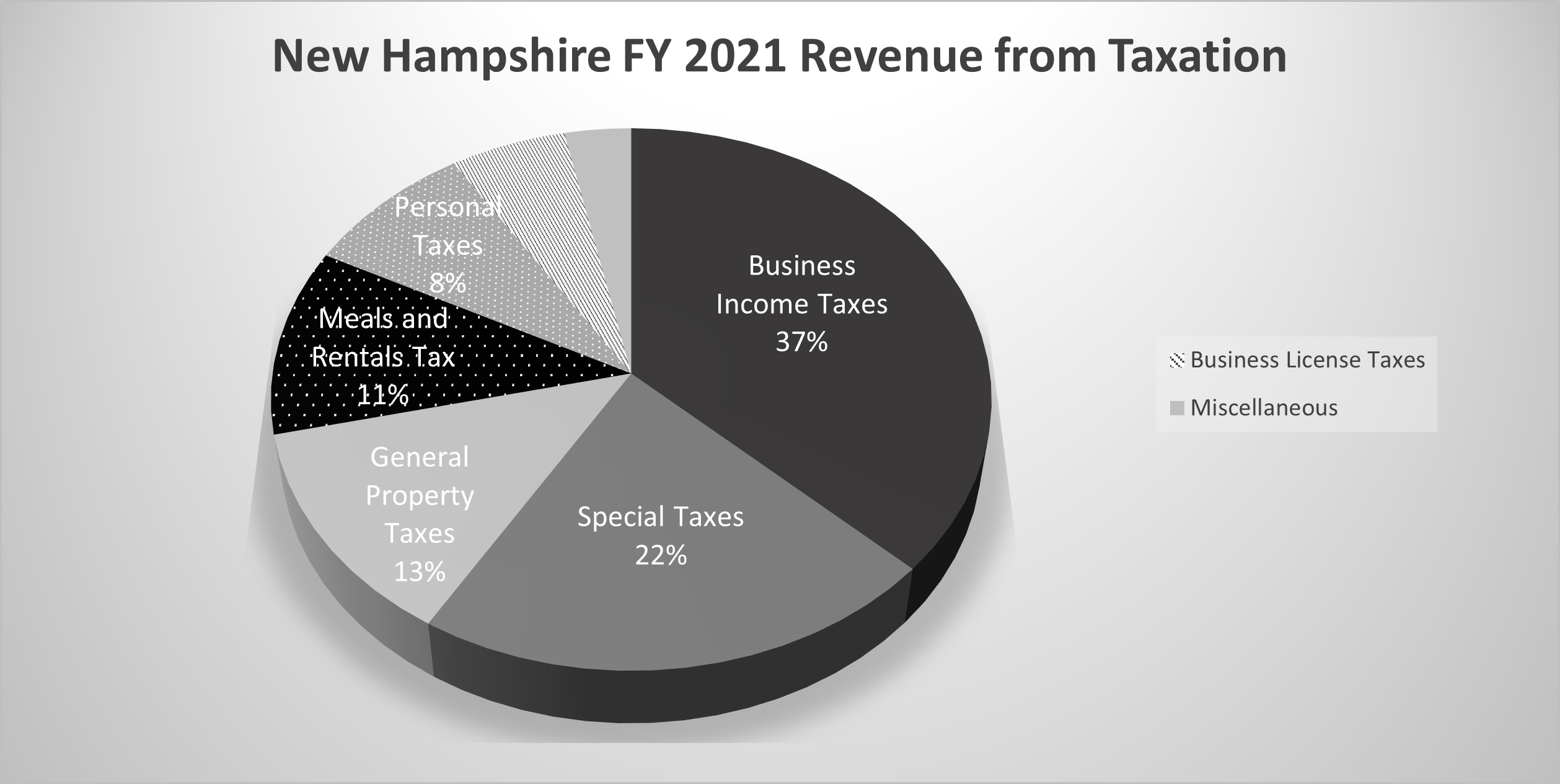

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

2021 Tax Rate Set Hopkinton Nh

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

Oct 15 Nhhfa Webinar Taxes Land Land Value Analysis Of 15 Communities Manchester Ink Link

How We Fund Public Services In New Hampshire New Hampshire Municipal Association